restaurant food tax in pa

Get a Food Establishment Retail Non-Permanent Location License. Every sale of wine.

Rizzo S Malabar Inn Crabtree Pa Stuffed Shells Drive Thru Special Thursday 7 23 Starts At 3 30 Facebook

Restaurant meals and general purchases are subject to an 8 percent sales tax whereas liquor is subject to a 10 percent sales tax.

. What is lower rate of tax for food and health. The 8080 rule applies when 80 of your sales are food and 80 of the food you sell is taxable. Pennsylvania grocery items are tax exempt and in Pennsylvania this includes candy and gum but not alcohol.

PA law states that sales tax will be imposed on food and beverages for consumption on or off the premises or on a take-out or to go basis or delivered to the. All Retail Food Facilities are regulated by The Food Code. Grocery Food EXEMPT In the state of Pennsylvania whether.

Pennsylvania law requires businesses that contract with restaurants or other businesses to collect sales tax on customers orders. In this case 40000 25000 15000 so the bar would owe tax on that 15000. That includes the cost of taxable items purchased as.

Depending on the type of business where youre doing business and. Examples of dealers are delis restaurants and grocery stores as well as hospitals schools nonprofit groups and. The Pennsylvania state sales tax rate is 6 and the average PA sales tax after local surtaxes is 634.

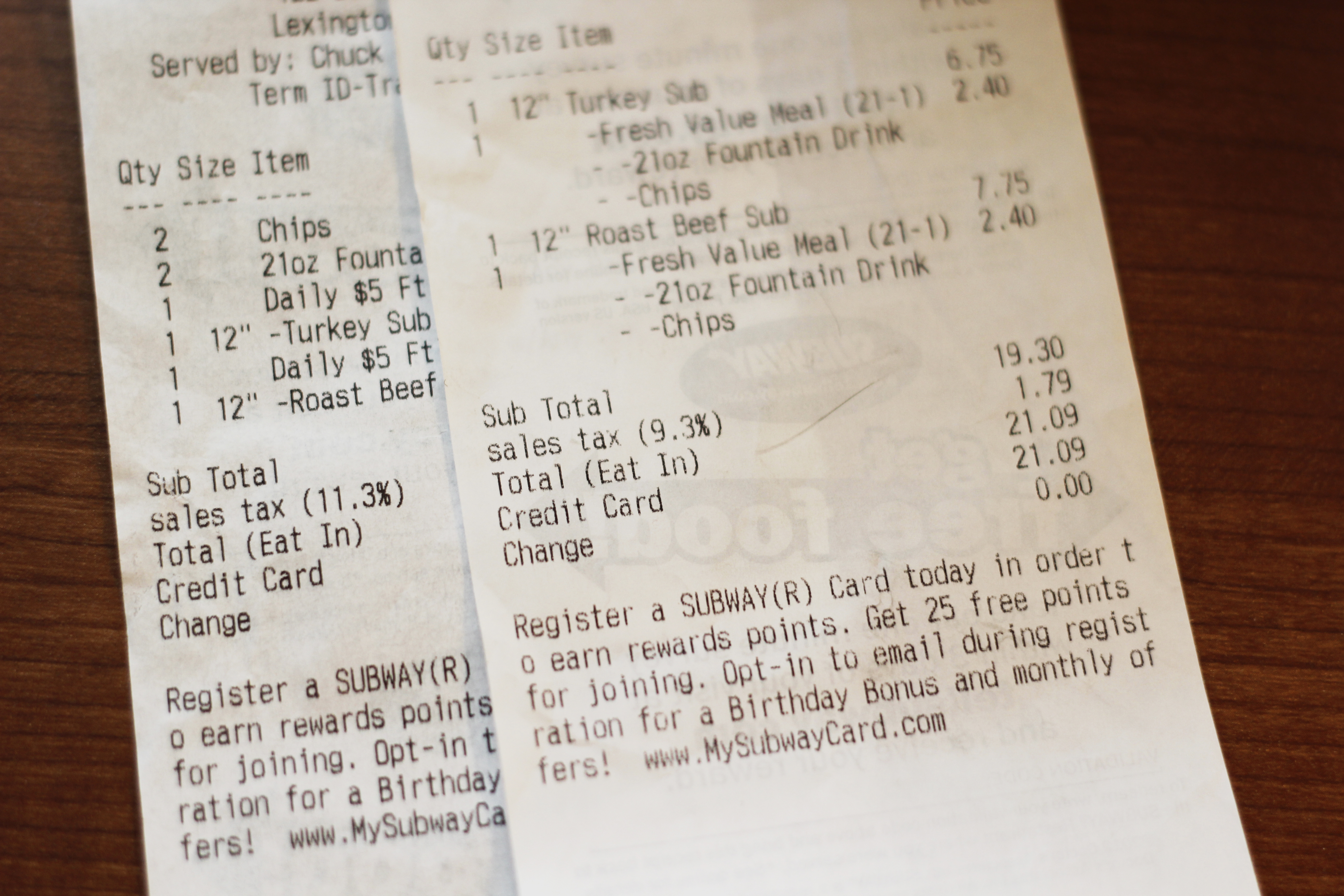

Burger coupon by the restaurant along with the description of the item and coupon on the register receipt establishes a new taxable purchase price of 3 which is subject to 12 cents in tax. Retail food facilities are governed by Title 3 of the Consolidated Statutes Chapter 57 - Food Protection 3 CSA. 7272 states that the department or any of its authorized agents are authorized to examine the books papers and records of any taxpayer in order to verify the accuracy and.

If this rule applies to you and you do not separately track sales of cold food. 21600 for a 20000 purchase. In general the sale of food and non-alcoholic beverages by a caterer or eating establishment in Pennsylvania is subject to tax regardless of whether the customer is dining in or taking out.

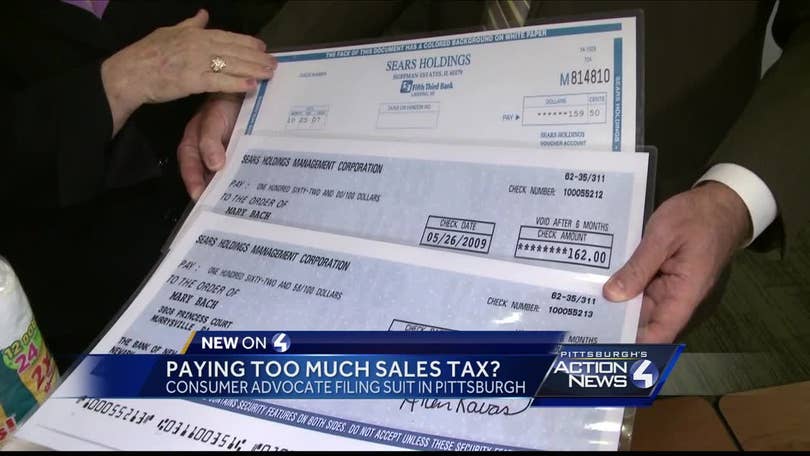

If you get audited being able to quickly provide any evidence your auditor asks for can. For example here is how much you would pay inclusive of sales tax on a 20000 purchase in the cities with the highest and lowest sales taxes in Pennsylvania. The Liquor Tax is applied to the sale price of alcoholic beverages purchased at bars restaurants catered events and at retail stores.

Clothing and food purchased at a grocery. Groceries clothing prescription drugs and non-prescription drugs are exempt from the. A Pennsylvania Meals Tax Restaurant Tax can only be obtained through an authorized government agency.

Catering TAXABLE In the state of Pennsylvania any gratuities that are distributed to employees are not considered to be taxable. Generally tax is imposed on food and beverages for consumption on or off the premises or on a take-out or to go basis or delivered to the purchaser or consumer when. The current rate is 10.

Best Local Restaurants In Mountain Top Pennsylvania Oct 2022 Restaurantji

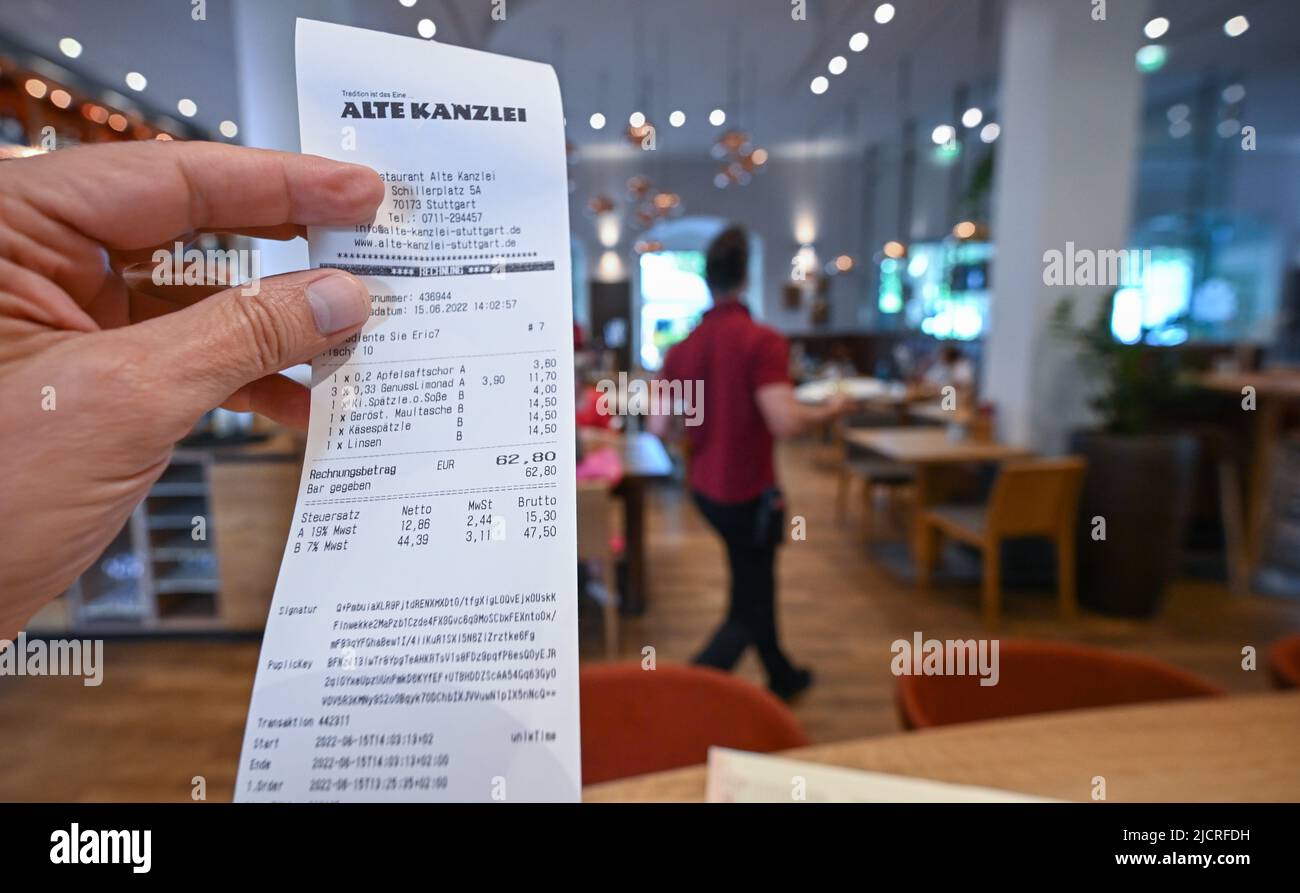

Stuttgart Germany 15th June 2022 A Hand Holds A Bill With Two Different Vat Rates For Drinks And Food In A Restaurant In Stuttgart Posed Scene Restaurateurs In The Southwest Plead For

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Online Menu Of Three Brothers Grill Restaurant Reading Pennsylvania 19601 Zmenu

Crossroads Family Restaurant Menu In Reading Pennsylvania Usa

Menu Of Villa Rosa Restaurant Pizza In Yardley Pa 19067

Caretti S Pizza And Italian Restaurant Menu In Chambersburg Pennsylvania Usa

Sales Taxes On Soda Candy And Other Groceries 2018 Tax Foundation

Virginia Counties Want Right To Raise Restaurant Tax Rockbridge Report

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Nevada Sales Tax On Restaurants And Bars Sales Tax Helper

Gnocchi Restaurant Philadelphia Pa Opentable

Sicily Pizza Restaurant Iii Menu In Bethlehem Pennsylvania Usa

Understanding California S Sales Tax

Everything You Don T Pay Sales Tax On In Pennsylvania From Books To Utilities On Top Of Philly News

Pennsylvania Sales Tax Which Items Are Taxable And What S Exempt

Online Menu Of Napolis Pizza Restaurant Pittston Pennsylvania 18640 Zmenu